Crowdlending is sometimes called P2P, P2P Lending, Marketplace Lending or P2P Loans. Despite the different names the meaning is the same – crowdlending is where private individuals or institutions lend to projects that require funding, without any bank involvement. In exchange, they receive a return on their investment, hence the name P2P, which means peer-to-peer.

Crowdlending should not to be confused with crowdfunding, which is mainly concerned with raising equity for start-ups. In contrast crowdlending is geared towards established small and medium-sized businesses (SMEs) and is debt-based, not equity-based. This means SMEs don’t have to give up a share of their business to finance growth and can bypass the banks, which have become more reluctant to lend to smaller companies since the global financial crisis.

Crowdlending platforms like MytripleA, bring together private individuals looking to make a profit and companies seeking finance, through an online marketplace. Despite the huge success of these platforms there is lots of misunderstanding surrounding P2P Lending. We have put together some research to highlight the role P2P platforms and how they are supporting SME growth.

What are the main benefits of P2P Lending?

P2P Lending for investors:

- Higher returns: P2P Lending provides higher returns on savings when compared with leaving them sitting in the bank. For example, MytripleA’s average return in March 2016 was 7.4%, whereas bank deposits are yielding around 2%.

- Investor choice: P2P Lending allows investors to choose what projects they want to invest in. In addition, you choose the term, amount, risk and, therefore, the likely profit. The principle behind crowdlending is to source a loan from a ‘crowd’ of many investors, each contributing a small proportion of the overall amount. By committing only small amounts to any one loan, investors can spread their overall risk.

P2P Lending for companies:

- Speed and agility: P2P loans involve a much faster and agile process than applying for a loan from a bank. Borrowers apply online, generally for free, and their application is quickly reviewed and verified by an automated system, which also determines the borrower’s credit risk and interest rate.

- Better conditions: In the majority of cases, P2P lending does not involve expenses or fees to obtain a loan and the conditions are normally much more adaptable and flexible. For example, no other products have to be contracted and full and partial amortisation is possible, completely free of charge. In addition, P2P financing leaves no records in the Bank of Spain’s debt database. This makes it much more attractive than banking debt.

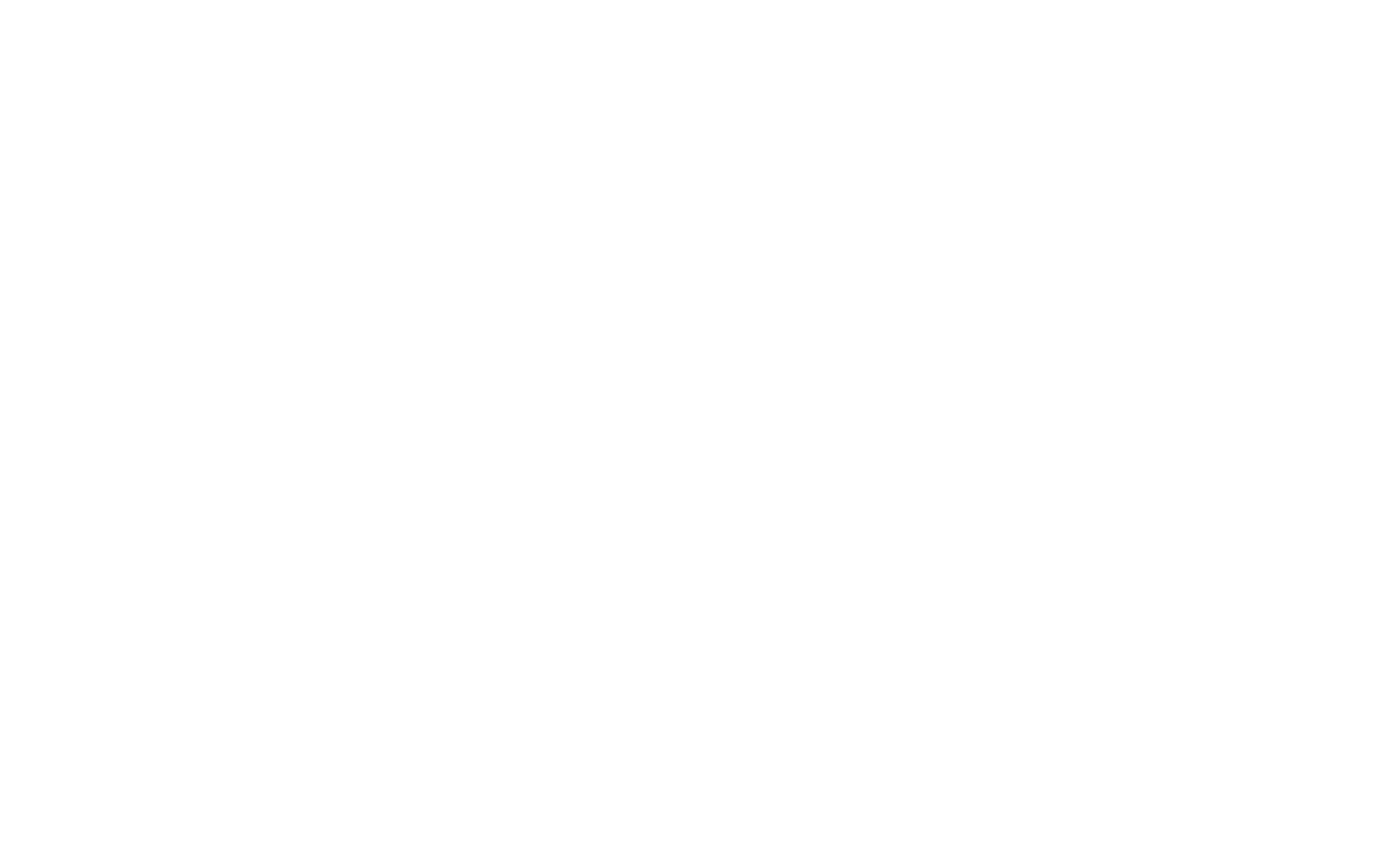

Infographics P2P Lending & P2P Loans in Spain

What can we tell you about P2P Lending platforms?

To prepare this post, we did some research on the eight Crowdlending platforms in Spain.

P2P platforms and their creation

There are currently eight P2P Crowdlending platforms in Spain and all of them are very young. The oldest began operating in 2009, however the majority started business between 2012 and 2014, which is when the P2P lending phenomenon boomed in our country. Each P2P lending platform has its own business model (invoice financing, small and short business loans, term business loans)

Purpose of P2P loans

75% of the P2P platforms operating in Spain only manage the funding of business projects and not personal loans. The remaining 25% accept all types of personal and business projects.

P2P lending terms

All platforms include short and long-term projects in their marketplaces, with the exception of one, which focuses only on discounting promissory notes for companies and therefore does not exceed a term of 12 months.

Minimum investment in P2P platforms

People can invest as little as €20 into a loan. To begin operating 60% of platforms allow investments from €50, whereas the others require amounts of €100, €20 or €25.

What can we tell you about P2P platform projects?

We chose three to four projects per platform, making a total of 29 projects analysed and the details on each project are provided.

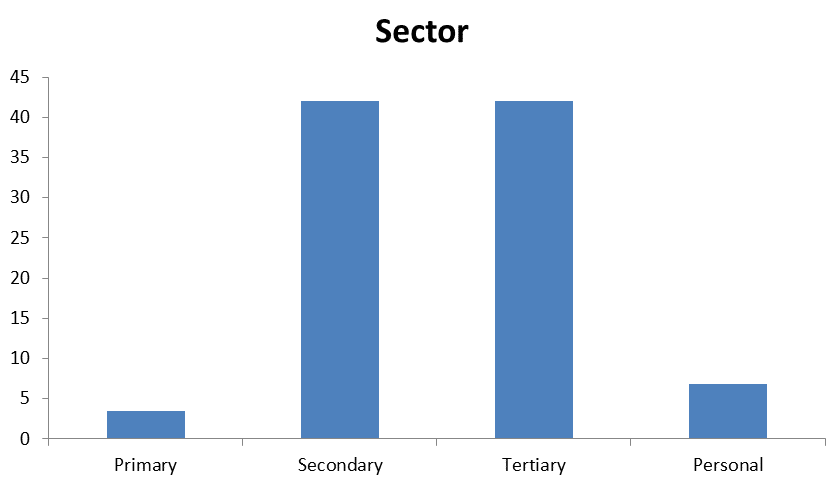

P2P sectors

According to the projects chosen, the sectors in which the companies, entrepreneurs and independent contractors that request funding operate are equally distributed in the tertiary sector and secondary sector, with approximately 42% each. The third and fourth positions are held by personal projects representing 7% and, finally companies operating in the primary sector make up for 3.44%.

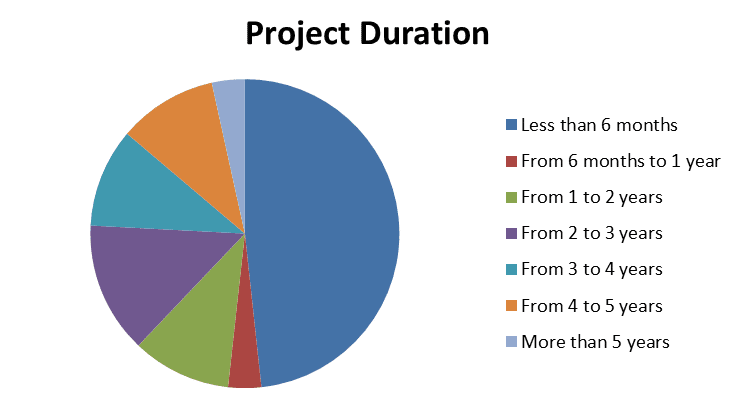

Duration of P2P loans

Of the projects chosen, the majority of 48.2% have a duration of less than 6 months, 3% from 6 months to 1 year, 10.34% have a return term of 1 to 2 years, 14% from 2 to 3 years and those with a duration exceeding 5 years only represent 3%.

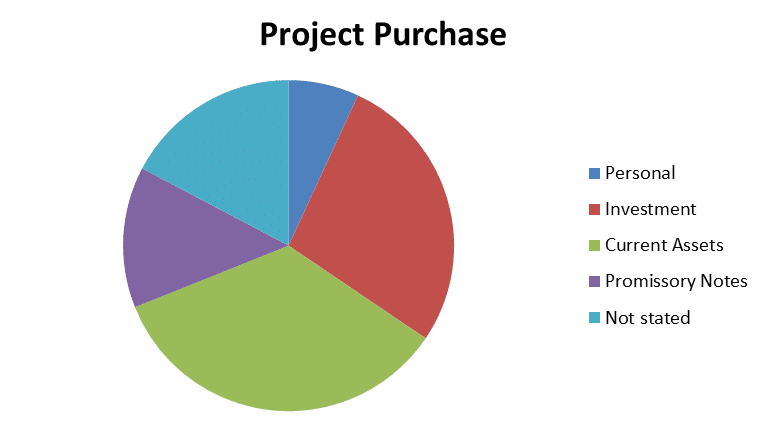

Purpose of P2P Loans

After determining the purpose of the funding for the projects, we see that the majority of 34.8% is for current assets, followed by 28% for investment and 14% for discounting promissory notes. It is clear that loans to purchase current assets are the most common and these projects also have a shorter duration.

P2P Loan amounts

The total funds requested for all the projects amounts to €1,404,530 which, divided amongst the 29 projects analysed gives an average of €48,000 per project. However, the projects involving the lowest amounts are those classified as personal loans from €2,000 to €3,000 and the highest amounts for investment of around €100.000. As far as current assets are concerned, the amounts vary from one project to another, but are normally around €35,000.

Return on P2P Loans

The average return on all the projects analysed is 8.87%, personal projects being those with the highest return, given their degree of risk, in some cases reaching 18%. The lowest return of the projects analysed was that of 4.50% from an investment project in a tourist resort.

P2P Loan Risk Rating

The rating varies as each platform uses different criteria. However, the most common project rating is a B.

P2P Lending Guarantees

In addition to the borrower, the majority of the loans are personally guaranteed by the shareholders or directors of the SMEs.

Crowdlending offers win-win opportunities for both investors and borrowers. With much faster decisions and better terms for SMEs and higher returns for investors, we believe it will be one of the fastest growing segments of the alternative finance sector.